Introduction

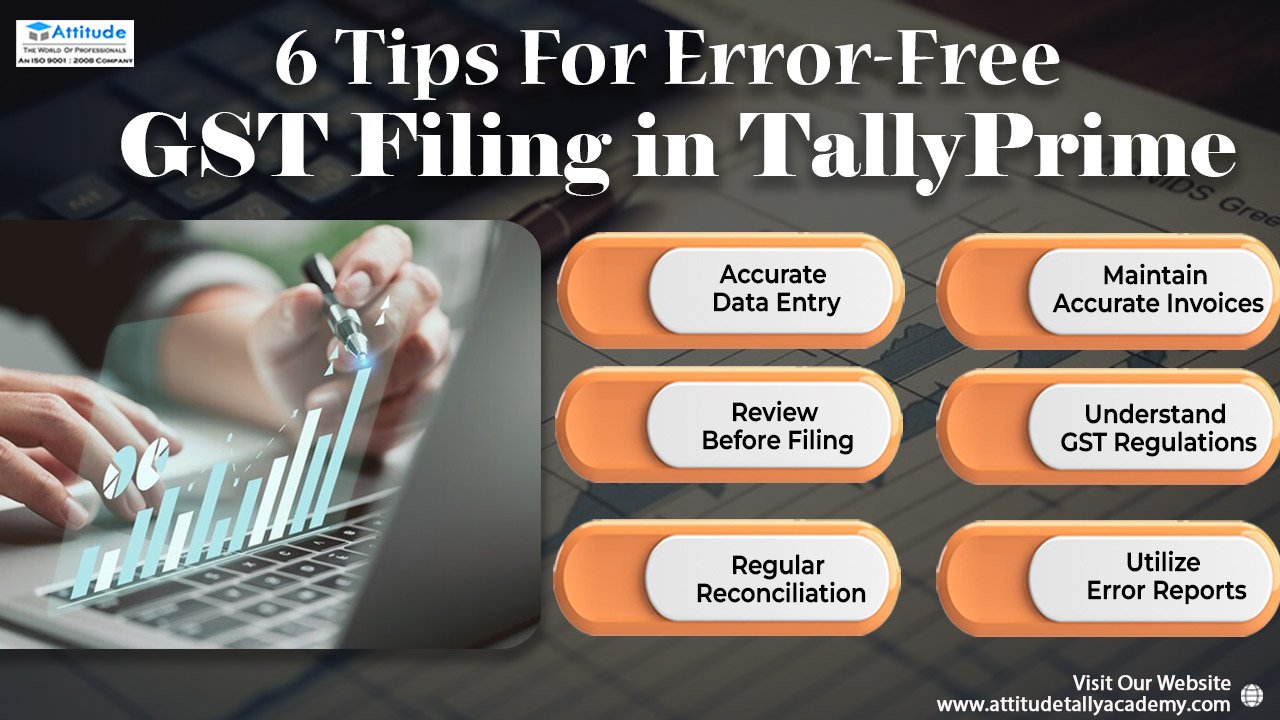

GST filing is a crucial task for any business, ensuring compliance with tax regulations and avoiding penalties. TallyPrime simplifies this process with its robust features, but following some essential tips can make your GST filing experience seamless and error-free. Here are six tips to help you achieve accurate and efficient GST filing tips in TallyPrime.

- Accurate Data Entry

Accurate data entry is the cornerstone of error-free GST filing. Ensure that all your transaction details are entered correctly in TallyPrime. Double-check for typographical errors, correct GST rates, and proper categorization of goods and services. Accurate data entry minimizes the risk of discrepancies and ensures your GST returns reflect true business activity.

- Maintain Accurate Invoices

Maintaining accurate invoices is vital for GST compliance. In TallyPrime, make sure your invoices include all necessary details such as the GSTIN of the supplier and recipient, invoice number, date, and accurate tax amounts. Keeping your invoices precise and up-to-date helps in smooth reconciliation and filing.

- Review Before Filing

Before finalizing your GST return, always review your data thoroughly. TallyPrime offers various reports and tools to help you analyze your GST data. Review your sales and purchase registers, tax liability reports, and other relevant documents. Catching and correcting errors before filing can save you from future complications.

- Understand GST Regulations

Having a clear understanding of GST regulations is essential for accurate filing. Stay updated with the latest GST rules and amendments. TallyPrime’s built-in compliance features are regularly updated to reflect the latest changes in GST laws. Keeping yourself informed ensures that your GST filings are always compliant with the latest regulations.

- Regular Reconciliation

Regular reconciliation of your books with your GST returns is crucial. TallyPrime provides tools to help you reconcile your sales and purchase data with the data available on the GST portal. Regular reconciliation ensures that your books are always aligned with your GST returns, reducing the chances of discrepancies.

- Utilize Error Reports

TallyPrime offers comprehensive error reports that can help you identify and correct errors before filing your GST return. Make it a habit to run these error reports regularly. Address any issues highlighted in these reports to ensure that your GST filing is error-free and compliant.

Conclusion

Following these six tips can significantly streamline your GST filing process in TallyPrime, ensuring accuracy and compliance. Accurate data entry, maintaining precise invoices, thorough review, understanding GST regulations, regular reconciliation, and utilizing error reports are key to achieving error-free GST filing. Embrace these practices to simplify your GST compliance and focus more on growing your business.

Implementing these tips will not only make your GST filing process smoother but also help you avoid penalties and ensure your business stays compliant. TallyPrime is designed to make GST compliance easier, and with these best practices, you can make the most out of its features. Happy filing!

Suggested Link: –