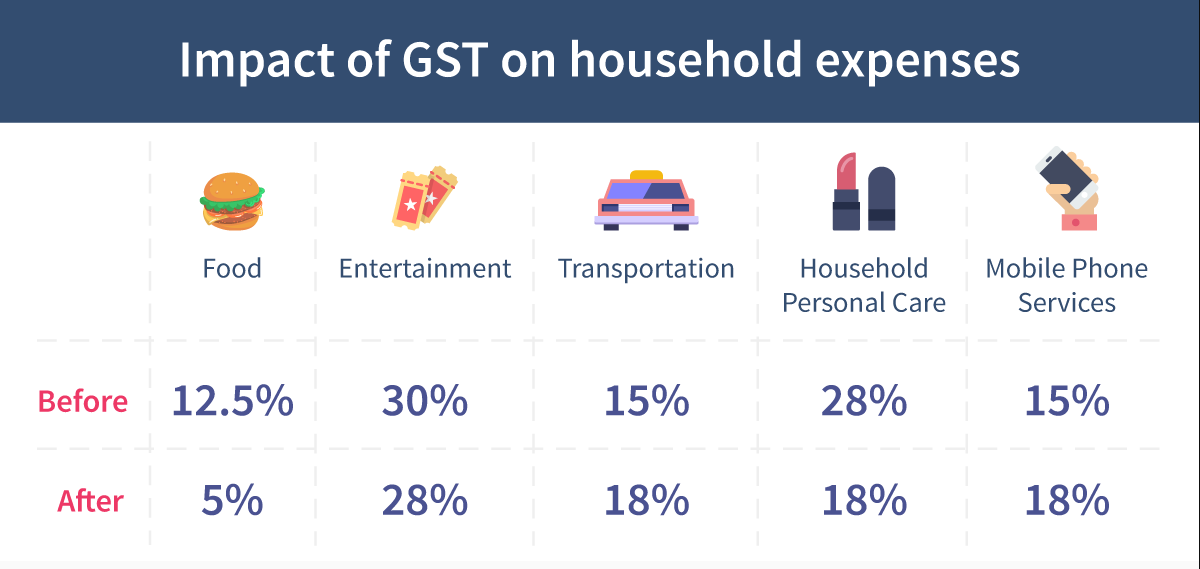

The GST council has raised the veil from GST rates across various goods and services. Just Check out that what rates will be applicable on distinct goods and services.

GST council has made the much-awaited declaration around tax rates on various divisions of goods on day one of a two-day conference of the said council at Srinagar. There has been a extensive publicity around these rates for a while and now these rates are finally publically announced.

As soon as the GST rates were declared a huge wave of eagerness hit across industry and trade bodies. All peoples are evaluating their position as a result of this advancement. So in this blog, we bring you our investigation on these GST rates.

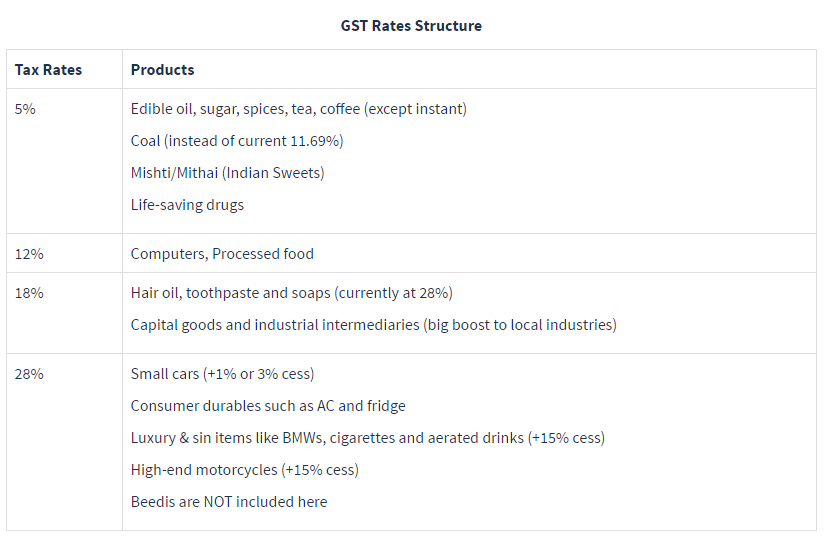

We previously know that the GST slabs are fixed at 5%, 12%, 18% & 28%. According to the fresh news from the GST council, the tax structure for commonly-used goods are as under:

Notwithstanding the over, a couple of different things were specified in the Council’s declaration of rates. These things, and the material rates on them are as per the following:

1. Sugar, Tea, Coffee and Edible oil will fall under the 5 for every penny piece, while oats, drain will be a piece of the absolved rundown under GST. This is to guarantee that essential goods are accessible at reasonable costs. Be that as it may, moment sustenance has been kept outside this section along these lines, no alleviation for Maggie significant others!

2. The Council has set the rate for capital goods and modern middle of the road things at 18 for each penny. This will emphatically affect household makers as consistent info credit will be accessible for every capital great. Without a doubt, it is the ideal opportunity for “Make In India”.

3. Coal to be burdened at 5 percent against current 11.69 for every penny. This will demonstrate advantageous for the power segment and overwhelming ventures which depend on coal supply. This will likewise help check swelling. Expect a decent keep running for Coal India tomorrow.

4. Toothpaste, hair oil, and cleansers will all be exhausted at 18 percent, where right now they are saddled at 28 percent. The majority of the beauty care products and quick moving buyer goods (FMCG) brands ought to get the advantage of this assessment lessening. All things considered, Fair and Lovely may appear to be more pleasant in its estimating starting now and into the foreseeable future!

5. The “mithai” from the neighboring sweet shop may lose some of its flavor as Indian desserts will now be assessable at 5 for each penny. In the event that you have a sweet tooth, this could hurt your pocket a small piece in the coming days.

In addition, it was reported that:

1. for eateries serving liquor, the duty section will be 18 for each penny

2. instruction, human services will be exempted from GST

3. services on Non-AC eateries will be 12 for each penny