Move arrangements in GST have experienced huge changes in the Revised Draft Model GST Law distributed on 26th November 2016. This post has been upgraded with changes in the modified draft law.

On the date of transitioning to GST, extensively there will be business who fall under any of the accompanying classes:

1.Organizations not at risk to be enrolled under the present law, yet are at risk for enlistment under GST

2.Business which are occupied with the produce or offer of exempted products or administrations

3.To begin with stage merchant or a moment organize merchant or an enlisted shipper

1.Businesses not at risk to be enrolled under the present law, yet are at risk for enlistment under GST

According to the Central Excise Act and Rules, an assembling unit is required to enroll if its total leeway esteem crosses Rs 1.5 crores, and necessities to release the obligation. Thus, under VAT, you are at risk for enlistment if your turnover amid the money related year crosses as far as possible. As far as possible varies from state to state.

Today, you may not be obligated for enlistment as your edge confine does not surpass as far as possible. Nonetheless, you get to be distinctly obligated to enroll under GST, if your edge confine surpasses Rs 10 lakhs for Special Category States (Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand) and Rs 20 Lakhs for whatever remains of India.

2.Business which are occupied with the fabricate or offer of exempted products or administrations.

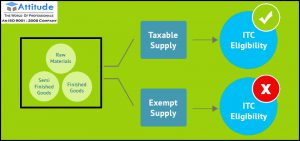

You might be presently occupied with the make, offer of exempted merchandise or arrangement of exempted administration, yet on move to GST, these are assessable

3.First phase merchant or a moment organize merchant or an enrolled shipper

As a merchant, you are obligated for enlistment under Central Excise on the off chance that you exchange excisable merchandise. Today, the extract obligation you pay won’t be accessible as credit, as a first stage or second stage merchant adds the extract obligation paid to the cost of the item. In the event that it is sold to a producer, the extract obligation passed on, will be asserted as CENVAT credit by the purchasing maker.

thus, you have to enroll under Central Excise as a shipper on the off chance that you are bringing in the products, and release the relevant import obligation.

Under previously mentioned situation, the normal question each business will have is “Would I be able to profit Input Tax credit on the stock hung on the most recent day before GST usage”?

Yes, you will be permitted profit the Input Tax credit (CENVAT, input VAT, passage assessment and Service Tax) held in the end supply of data sources (crude materials), semi-completed merchandise, and completed products. In any case, there are conditions that you have to meet to be qualified to profit Input Tax credit held in your end stock.

Qualification conditions to profit Input Tax credit held in your end stock

You can profit Input Tax credit held in your end stock if,

- 1.The end stock is held either as crude materials, semi-completed products, or completed merchandise, and should be utilized or planned to be utilized for assessable supplies.

2.The advantage of such credit is passed on, by method for diminished costs, to the recipient.In current expense administration, obligation/duty is included as item cost since the Input Tax Credit is not permitted. On move to GST, ITC will be permitted, and this ought to actually bring about the decrease of base cost, and thusly lessened last cost to clients.

3.You are qualified for info impose credit under GST. In GST, you are qualified for Input Tax credit on the off chance that you are a customary citizen as it were. An assessable individual selecting structure collect under GST is not permitted to claim Input Tax credit.

4.You have solicitations or some other endorsed obligation/assess paying records in regard of the end load of sources of info (counting semi-completed merchandise and completed products).

5.The date of solicitations or some other endorsed obligation/assess paying records is inside 12 months from the date of transitioning to GST.

Give us a chance to comprehend this with a case.

Ravindra Automobiles is an enlisted extract merchant in autos and auto save parts. On first March, 2017, Ravindra Automobiles bought save parts, and the points of interest of exchange are given underneath:

| Date | Stock Item | Qty | Rate / qty | Total Value | Vat @ 14.5% | Excise Duty 12.5% |

| 01-03-2017 | Spares | 50 Nos | 1500 / Nos | 75,000 | 10,875 | 9,375 |

As on 31st March, 2017, the end supply of extras held by Ravindra Automobiles is 30 Nos.

According to the present duty structure, Ravindra Automobiles can profit the Input VAT of Rs 10,875 as credit, and can set this sum against the yield VAT. Be that as it may, extract obligation is not permitted as Input Tax credit. Hence, it is added to the item cost. Presently, on transitioning to GST, Ravindra Automobiles is permitted to profit the Input Tax credit of extract obligation on the end stock held by them.

Give us a chance to consider the above illustration and figure the extract obligation on shutting stock, which can be benefited as Input Tax credit.

| Closing Stock as on 31-3-2017 | 30 Nos | Closing Stock as on 31-3-2017 |

| Duty Column: Lilly unveils a ‘generic’ insulin and shows how broken our healthcare system really is buy kamagra 100mg online blue wave watch: generic ballot gap shrinks again, democratic registration falls in key state Per Unit ( Total Excise Duty 9,375 / Quantity 50 Nos ) | 187.5 / Unit | Duty Per Unit ( Total Excise Duty 9,375 / Quantity 50 Nos ) |

| Balance Duty on closing Stock (Duty per unit 187.5 * Closing Stock 30 Nos ) | 5,625 | Balance Duty on closing Stock (Duty per unit 187.5 * Closing Stock 30 Nos ) |

Presently, Ravindra Automobiles realizes that they can profit the extract obligation of Rs 5,625 on the end stock held, yet would they say they are qualified to benefit it?

To be qualified, Ravindra Automobiles needs to meet the accompanying conditions:

1.The shutting stock held must be utilized or expected to be utilized for assessable supplies.

Yes, the end load of 30 nos will be utilized for assessable supplies.

2.The advantage of such credit must be passed on, by method for lessened costs, to the beneficiary.

Since Input Tax credit is accessible, Ravindra Automobiles will no longer add this to the item cost. Accordingly the base cost will decrease, and in this manner result in lessening of cost.

3.They are qualified for Input Tax credit under GST.

4.They ought to have solicitations or some other endorsed obligation/charge paying records in regard of shutting supply of data sources (counting semi-completed merchandise and completed products).

Ravindra Automobiles has the Rule 11 receipt issued by their provider (Manufacturer) in regard the end supply of 30 nos.

5.The date of solicitations or some other endorsed obligation/charge paying records must be inside 12 months from the date of transitioning to GST.

The end load of 30 nos held is against the buy dated 1-3-2017, which is inside 12 months, expecting GST will be actualized on 1-4-2017

Ravindra Automobiles meets all the above conditions and is qualified to profit the extract obligation of Rs 5,625 as CGST Input Tax credit.