Introduction

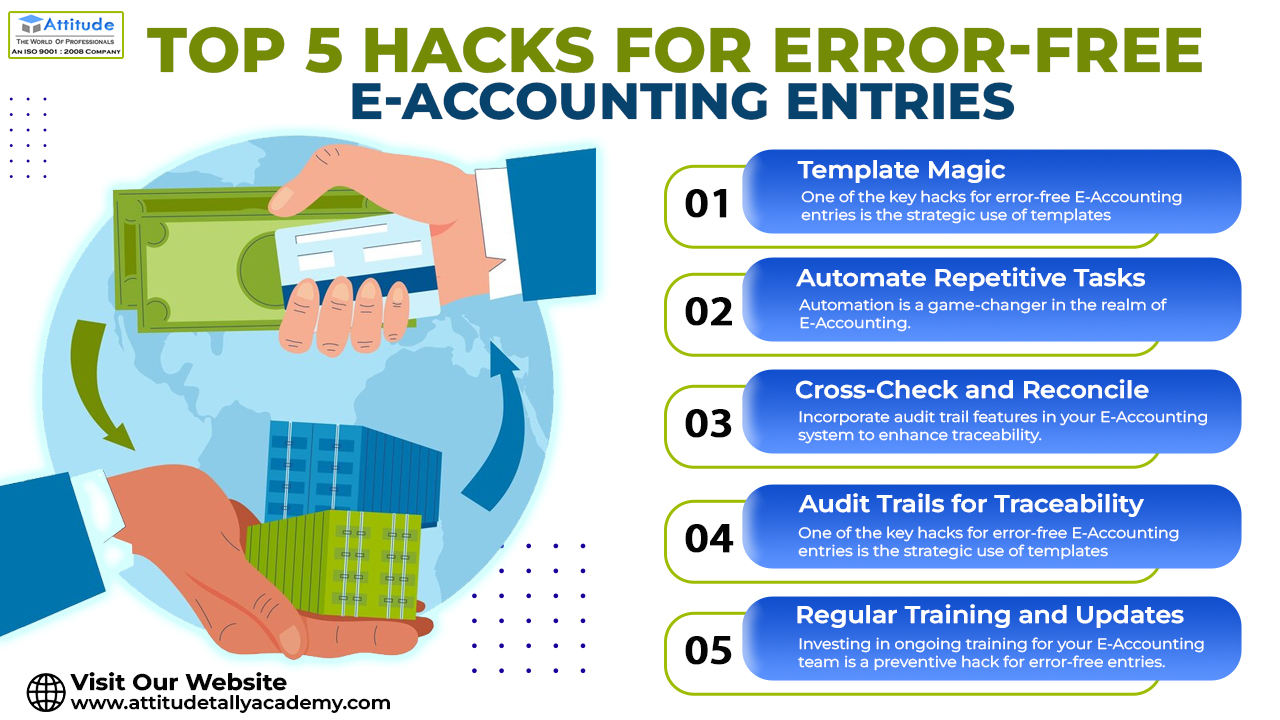

In the fast-paced world of financial accounting, accuracy is paramount. A single error in your e-accounting entries can lead to a cascade of issues, from skewed financial reports to compliance headaches. However, mastering error-free e-accounting doesn’t have to be an uphill battle. With the right strategies and tools at your disposal, you can streamline your processes and ensure precision every step of the way. Here are five hacks to help you achieve error-free e-accounting entries effortlessly.

Template Magic: One of the simplest yet most effective ways to minimize errors in your e-accounting entries is by leveraging templates. E-accounting software tricks often include pre-built templates for common transactions such as invoices, receipts, and purchase orders. By utilizing these templates, you not only save time but also reduce the risk of manual data entry errors. Make sure to customize your templates to suit your specific business needs for maximum efficiency.

Automate Repetitive Tasks: Automation is a game-changer in the world of e-accounting. Take advantage of features offered by your e-accounting software to automate repetitive tasks such as data entry, invoicing, and reconciliations. By automating these processes, you not only free up valuable time but also significantly reduce the likelihood of human error. Explore the automation capabilities of your software and streamline your workflows for error-free accounting.

Cross-Check and Reconcile: Even with templates and automation in place, it’s crucial to cross-check and reconcile your e-accounting entries regularly. Set aside dedicated time each week or month to review your transactions, verify balances, and reconcile accounts. Look for discrepancies or anomalies that may indicate errors and address them promptly. By staying vigilant and proactive, you can catch and correct errors before they escalate into larger issues.

Audit Trails for Traceability: E-accounting software often provides audit trail functionality, allowing you to track changes made to your financial data. Take advantage of this feature to maintain traceability and accountability in your accounting processes. Keep a log of who made each change, when it was made, and the reason behind it. Audit trails not only help prevent errors but also facilitate compliance with regulatory requirements and internal policies.

Regular Training and Updates: The world of e-accounting is constantly evolving, with software updates, regulatory changes, and new best practices emerging regularly. Ensure that your team stays up-to-date with the latest developments by providing regular training sessions and staying informed about industry trends. By investing in ongoing education and professional development, you empower your team to navigate e-accounting challenges with confidence and accuracy.

In conclusion,

Error-free accounting techniques are achievable with the right strategies and tools in place. By harnessing the power of templates, automation, cross-checking, audit trails, and ongoing training, you can streamline your processes and minimize the risk of errors. Implement these hacks in your e-accounting workflows, and watch as your accuracy soars and your financial operations thrive.

Suggested Link: – TallyPrime With GST