Enter Your Details

Complete e Accounting tutorial from the very basics to the advanced concepts and adjustments ?

Be able to operate a PC. That's all.

.jpg)

.jpg)

7 Days Money back Guarantee*

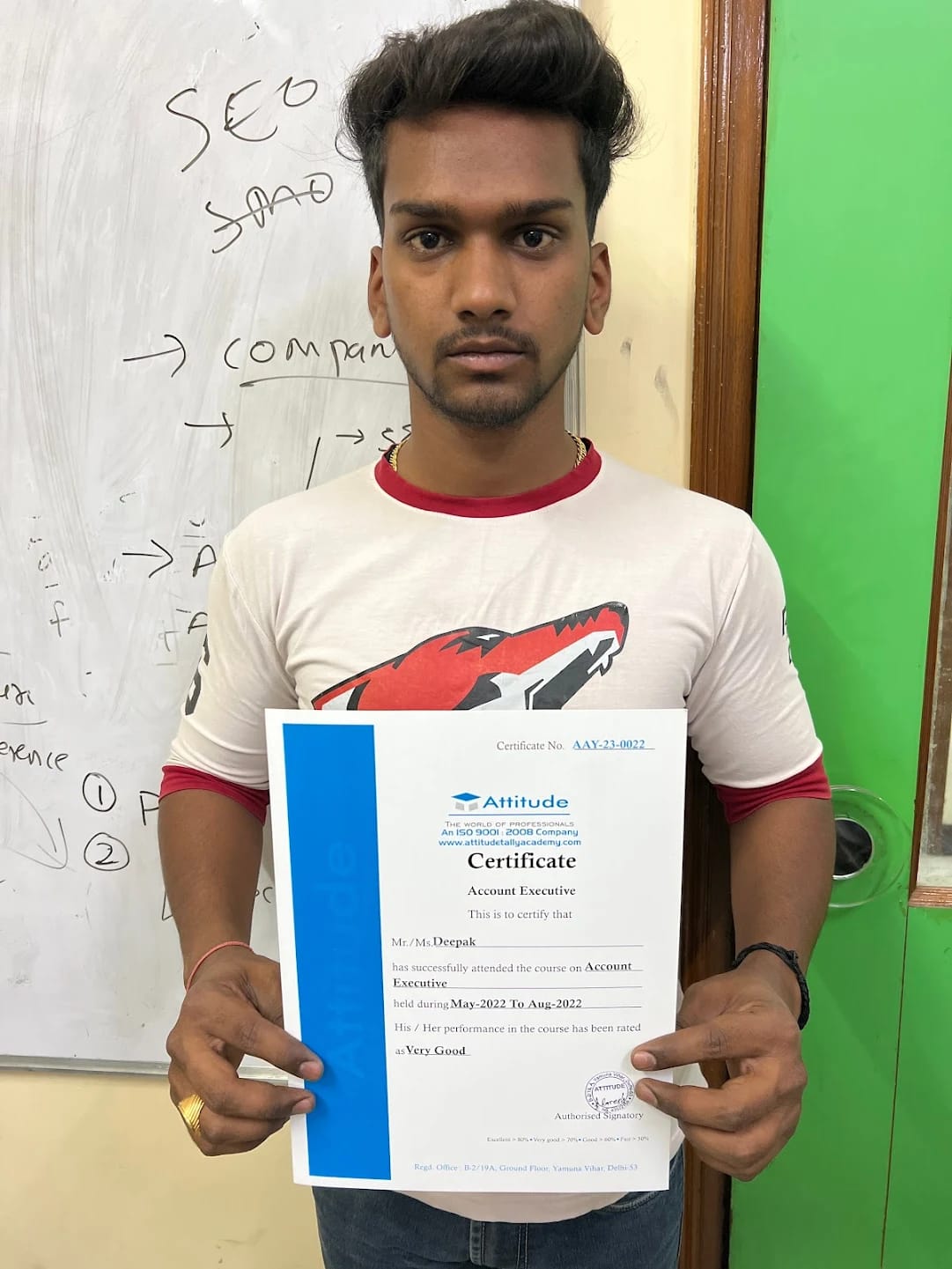

Take the final exam online to complete the e Accounting From Beginner to Expert after which you will be able to download your certificate from Attitude Trainings

Be able to operate a PC. That's all.

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in e Accounting From Beginner to Expert

e Accounting is composition of two words E and Accounting. E means electronic in which every record is in electronic form and not on paper. In current time e Accounting plays an important role in every business organization of small and big scale in day to day life. In this electronic accounting system source documents and accounting records exist in digital form instead of on paper. It is an application of online and internet technologies to the business accounting function. e Accounting course is new development in area of accounting.

There has been remarkable growth in this era of information and communication technology in business to support the exchange of data and information within and between organizations. This concept is opted at international level. There is large number of companies who started e Accounting as a training programme. Attitude tally academy offers e Accounting course online and Offline to students and professionals. who wish to curtail their burden of recording transactions on paper

Introduction of 'e' Filing of Income

How To Register PAN,TAN

Tax Returns Generation of IT Form ITR 01

Tax Returns Generation of IT Form ITR 02

Tax Returns Generation of IT Form ITR 03

Tax Returns Generation of IT Form ITR 04

Tax Returns Generation of IT Form ITR 05

Tax Returns Generation of IT Form ITR06

E-Way Bill is an electronic way bill for movement of goods which can be generated on the e-Way Bill Portal. Transport of goods of more than Rs. 50,000 in value in a vehicle cannot be made by a registered person without an e-way bill. Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

e Accounting is composition of two words E and Accounting. E means electronic in which every record is in electronic form and not on paper. In current time e Accounting plays an important role in every business organization of small and big scale in day to day life. In this electronic accounting system source documents and accounting records exist in digital form instead of on paper. It is an application of online and internet technologies to the business accounting function. e Accounting course is new development in area of accounting.

There has been remarkable growth in this era of information and communication technology in business to support the exchange of data and information within and between organizations. This concept is opted at international level. There is large number of companies who started e Accounting as a training programme. Attitude tally academy offers e Accounting course online and Offline to students and professionals. who wish to curtail their burden of recording transactions on paper

Introduction of 'e' Filing of Income

How To Register PAN,TAN

Tax Returns Generation of IT Form ITR 01

Tax Returns Generation of IT Form ITR 02

Tax Returns Generation of IT Form ITR 03

Tax Returns Generation of IT Form ITR 04

Tax Returns Generation of IT Form ITR 05

Tax Returns Generation of IT Form ITR06

E-Way Bill is an electronic way bill for movement of goods which can be generated on the e-Way Bill Portal. Transport of goods of more than Rs. 50,000 in value in a vehicle cannot be made by a registered person without an e-way bill. Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in e Accounting From Beginner to Expert

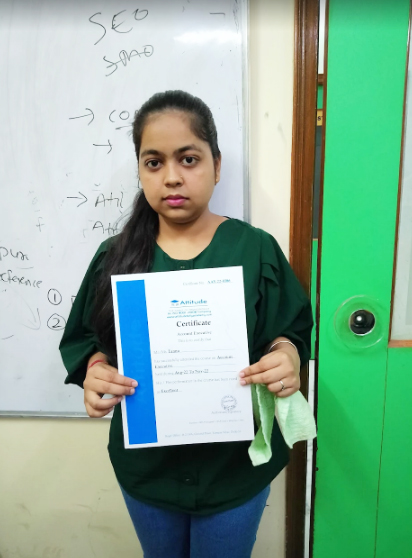

Uncover an exceptional opportunity at ATTITUDE Academy, where we introduce our meticulously crafted course designed to immerse participants in the foundational principles and standards of our esteemed e-accounting Training System. Strategically located in Uttam Nagar and Yamuna Vihar, Delhi, as an authorized e-accounting training center, we specialize in integrating e-accounting, providing comprehensive training with industry-standard tools.

Upon completion of our esteemed e-accounting course, individuals will possess indispensable skills crucial for excelling in Real-Time Industries. Our e-accounting classes in Yamuna Vihar and Uttam Nagar, Delhi, ensure 100% job support and continuous access to course materials. Enroll in our e-accounting program today to master essential IT skills.

Committed to empowering learners with vital expertise for a thriving career, ATTITUDE Academy stands as a premier e-accounting training institute in Uttam Nagar and Yamuna Vihar. We excel in delivering a comprehensive curriculum covering various facets of e-accounting education, preparing individuals for roles such as Data Entry and Accountant. Through interactive classes and innovative approaches, we foster an environment conducive to student development.

Our experienced instructors, with a proven track record of successfully training over 10,000 scholars, provide personalized guidance in live design training. Practical exposure is facilitated through internship opportunities, while collaborative learning environments thrive in discussion zones. Offering options for both regular and weekend classes, students benefit from scheduling flexibility, and our thorough interview preparation ensures they are well-prepared for a prosperous future in the realm of e-accounting technology.

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

I recently completed the Financial e-Accounting program at Attitude Academy, and I must say, it was an exceptional educational journey. The course was both challenging and enriching, providing a deep dive into the subject matter. The instructors demonstrated profound expertise in their fields, and their passion for teaching was evident in every class. I highly recommend Financial e-Accounting at Attitude Academy to anyone seeking a top-notch education in a supportive and engaging atmosphere.

Attitude Academy is a practical technical institute and offers an ideal study environment for those who want experience both professionally and educationally. I found myself what I want to do in the future – to become an Accountant. I realized that both professional experience and higher education are important to achieve my future goal.

Being a student at Attitude Academy Yamuna Vihar as a super over experience. I am perceiving in financial accounting course I spend six month in this institute. I learnt so many things here there is not been academic also extra curriculum activities and at the end of the journey I was a completely different person, more confident, self dependent able to do anything by on able to face the world. Take on challenges and always smile Moka Milta

one of the best institute have ever seen .... even teachers are so much coperative... online class LMS portal is best for learning

Attitude Academy is one of the best Academy to learn Tally, GST, Basic of Computers. Faculty of this institute are very cooperative, polite and humble with their students. The best part of this institute is they provide online lerning facilities

Attitude academy is the best institute of Tally ERP9 with GST and Accounting in delhi. trainers are very helpful.

i am an accountant by profession and the hole credit goes to Attitude tally academy , specially Turab sir.. here i got basic to excellence knowledge of accounting

I am very much impressed with the faculty, the way of teaching and the most important and impressive is the real time project work which is 100% practical.

Mamta mam is best Tally GST Taxation trainer. Learning e-accounting in this institute in a better way.

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.