Enter Your Details

TallyPrime With GST

Basic knowledge of Functional of Computer

.jpg)

.jpg)

7 Days Money back Guarantee*

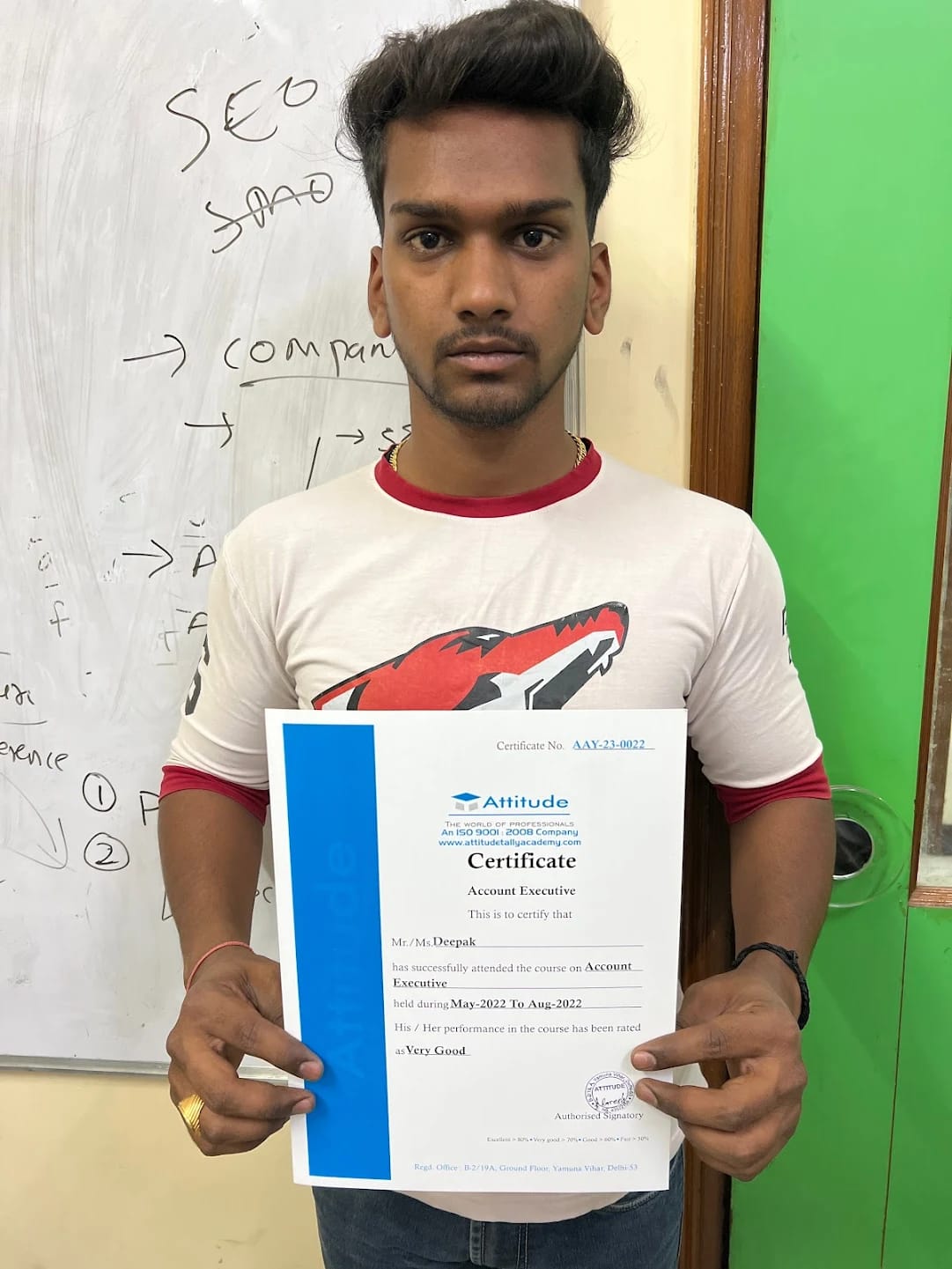

Take the final exam online to complete the TallyPrime With GST after which you will be able to download your certificate from Attitude Trainings

Basic knowledge of Functional of Computer

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in TallyPrime With GST

Advanced Financial Accounting with TallyPrime and GST

Fundamentals of TallyPrime

Create Accounting Masters in TallyPrime

Accounting Vouchers

Financial Statements and Accounting Books & Reports

Application Management

Online Help and Support

TallyPrime ODBC

Remote Access

Unit Creating In Inventory

Godown Creation

Inventory Vouchers

Generating Inventory Books & Reports

Purchase/Sale Order

Cost Centres and Cost Categories

Voucher Classes

Zero Value Entry

Additional Cost Of Purchase

Price Levels/Price List

Multiple Currencies

Interest Calculations

Budget & Controls

Scenario Management

Banking

Tracking Numbers

Batch – wise Details

Bill of Materials (BoM)

Stock Valuation

Inventory Analysis

Different Actual and Billed Quantities

Job Costing

Job Order Processing

Generation Employees

Salary Structure

Calculation Attendance & Leave Details

Salary Slip Generation, PF, ESI, Gratuity Bonus,

Various Analytical Reports etc.

Activating GST for Your Company

Setting Up GST Rates

Updating Stock Items and Stock Groups for GST Compliance

Updating a Service Ledger for GST Compliance

Updating Sales and Purchase Ledgers for GST Compliance

Updating Party GSTIN.

Creating GST Ledgers

Recording Sales and Printing Invoices

Recording Purchases

Sales - Nil Rated, Exempt

Recording Sales Returns

Recording Purchase Returns

GSTR-1, GSTR-2, GSTR-3, GSTR-2A

Returns Summary

Table-wise GSTR-1, GSTR-3

Exporting GSTR-1 ,GSTR-2, GSTR-3, GSTR-9

GST Reports

Communication, Listening & Comprehension, Real Life Scenarios,

Interview Skills

Special Classes on PDP (Body Language) etc.

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Advanced Financial Accounting with TallyPrime and GST

Fundamentals of TallyPrime

Create Accounting Masters in TallyPrime

Accounting Vouchers

Financial Statements and Accounting Books & Reports

Application Management

Online Help and Support

TallyPrime ODBC

Remote Access

Unit Creating In Inventory

Godown Creation

Inventory Vouchers

Generating Inventory Books & Reports

Purchase/Sale Order

Cost Centres and Cost Categories

Voucher Classes

Zero Value Entry

Additional Cost Of Purchase

Price Levels/Price List

Multiple Currencies

Interest Calculations

Budget & Controls

Scenario Management

Banking

Tracking Numbers

Batch – wise Details

Bill of Materials (BoM)

Stock Valuation

Inventory Analysis

Different Actual and Billed Quantities

Job Costing

Job Order Processing

Generation Employees

Salary Structure

Calculation Attendance & Leave Details

Salary Slip Generation, PF, ESI, Gratuity Bonus,

Various Analytical Reports etc.

Activating GST for Your Company

Setting Up GST Rates

Updating Stock Items and Stock Groups for GST Compliance

Updating a Service Ledger for GST Compliance

Updating Sales and Purchase Ledgers for GST Compliance

Updating Party GSTIN.

Creating GST Ledgers

Recording Sales and Printing Invoices

Recording Purchases

Sales - Nil Rated, Exempt

Recording Sales Returns

Recording Purchase Returns

GSTR-1, GSTR-2, GSTR-3, GSTR-2A

Returns Summary

Table-wise GSTR-1, GSTR-3

Exporting GSTR-1 ,GSTR-2, GSTR-3, GSTR-9

GST Reports

Communication, Listening & Comprehension, Real Life Scenarios,

Interview Skills

Special Classes on PDP (Body Language) etc.

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in TallyPrime With GST

Embark on an exceptional opportunity at ATTITUDE Academy, where we introduce our meticulously crafted course designed to immerse participants in the foundational principles and standards of our esteemed Tally Prime with GST Training System. Strategically located in Uttam Nagar and Yamuna Vihar, Delhi, as an authorized Tally Prime with GST training center, we specialize in integrating Tally Prime with GST, providing comprehensive training with industry-standard tools.

Upon completing our esteemed Tally Prime with GST course, individuals will possess indispensable skills crucial for excelling in Real-Time Industries. Our Tally Prime with GST classes in Yamuna Vihar and Uttam Nagar, Delhi, assure 100% job support and continuous access to course materials. Enroll in our Tally Prime with GST program today to master essential IT skills.

Committed to empowering learners with vital expertise for a thriving career, ATTITUDE Academy stands as a premier Tally Prime with GST training institute in Uttam Nagar and Yamuna Vihar. We excel in delivering a comprehensive curriculum covering various facets of Tally Prime with GST education, preparing individuals for roles such as Data Entry and Accountant. Through interactive classes and innovative approaches, we foster an environment conducive to student development.

Our experienced instructors, with a proven track record of successfully training over 10,000 scholars, provide personalized guidance in live design training. Practical exposure is facilitated through internship opportunities, while collaborative learning environments thrive in discussion zones. Offering options for both regular and weekend classes, students benefit from scheduling flexibility, and our thorough interview preparation ensures they are well-prepared for a prosperous future in the realm of Tally Prime with GST technology.

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

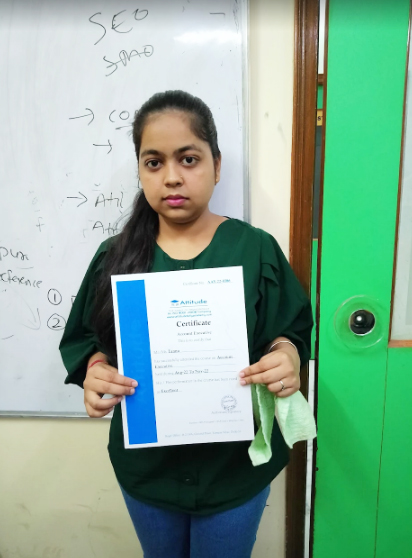

I recently completed the Financial e-Accounting program at Attitude Academy, and I must say, it was an exceptional educational journey. The course was both challenging and enriching, providing a deep dive into the subject matter. The instructors demonstrated profound expertise in their fields, and their passion for teaching was evident in every class. I highly recommend Financial e-Accounting at Attitude Academy to anyone seeking a top-notch education in a supportive and engaging atmosphere.

Attitude Academy is a practical technical institute and offers an ideal study environment for those who want experience both professionally and educationally. I found myself what I want to do in the future – to become an Accountant. I realized that both professional experience and higher education are important to achieve my future goal.

Being a student at Attitude Academy Yamuna Vihar as a super over experience. I am perceiving in financial accounting course I spend six month in this institute. I learnt so many things here there is not been academic also extra curriculum activities and at the end of the journey I was a completely different person, more confident, self dependent able to do anything by on able to face the world. Take on challenges and always smile Moka Milta

one of the best institute have ever seen .... even teachers are so much coperative... online class LMS portal is best for learning

Attitude Academy is one of the best Academy to learn Tally, GST, Basic of Computers. Faculty of this institute are very cooperative, polite and humble with their students. The best part of this institute is they provide online lerning facilities

Attitude academy is the best institute of Tally ERP9 with GST and Accounting in delhi. trainers are very helpful.

i am an accountant by profession and the hole credit goes to Attitude tally academy , specially Turab sir.. here i got basic to excellence knowledge of accounting

I am very much impressed with the faculty, the way of teaching and the most important and impressive is the real time project work which is 100% practical.

Mamta mam is best Tally GST Taxation trainer. Learning e-accounting in this institute in a better way.

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.